Is Sustainable Finance a catalyst for change?

There is much talk nowadays about sustainable finance – it appears to be of growing importance, as governments, businesses and individuals are engaging with it.

But let’s discover what it actually means, and how much it impacts the sustainability of our modern economics and – ultimately – how it impacts our planet.

Introduction to sustainable finance

Let’s start off with a definition put forward by the European Commission: According to their website:

…sustainable finance “refers to the process of taking environmental, social and governance -ESG- considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects…”

This definition refers to the concept of ESG, which is an increasingly popular term and is often based on actual measurable factors, which can result in ESG ratings for corporations. Popular data banks include the MSCI ESG Rating and S&P Global ESG Scores, among others. These are more and more used in order to evaluate the prospects of investing in companies.

A higher demand for transparency

Focusing beyond ESG aspect, the element of transparency is also essential, especially in relation to risks connected to ESG factors. For too long, risk factors such as social or environmental costs have been neglected in the banking and investment sector. This often led to the externalization of costs but could also result in dropping stock prices for the responsible corporations.

Governments are engaging

Sustainable finance is moreover linked to several government initiatives, like the growth strategy presented by the European Commission. This European green deal aims to make the continent climate-neutral by 2050 and invests in sustainable projects.

“Ecological and political turmoil is going to fundamentally change the financial sector. Companies which are prepared to adapt will not only be doing their part to realize European climate protection goals, they will also be able to pioneer new business areas and improve their own reputation.” Ullrich Hartmann, Partner, Head of Sustainable Finance at PwC Germany

Banks are adapting

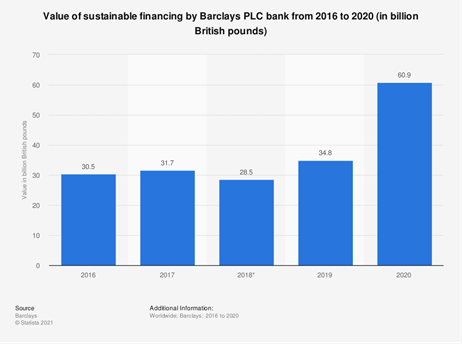

This quote highlights once more the importance of a sustainable transition in the financial sector. The change and increasing tendency can also be seen in the value of sustainable financing by Barclays PLC bank, with much higher values in 2020 compared to 2016. Similar trends can be observed in other global players. Overall, banks receive more external and internal pressure to adapt to the demands for more sustainability, leading to increases in sustainable finances.

Finances are essential

The financial services sector is a crucial part in the transition towards a sustainable economy, which makes these developments all the more important. Funding sustainable projects and businesses enables them to scale up, increasing their influence. In this manner, the banks have a guiding role in sustainability matters, by steering companies a certain way through finances. Ideally, they could serve as a catalyst for positive changes in the economy.

On an individual level

On another level, us as consumers also have the opportunity to make an impact: our purchasing decisions as well as our investment choices affect businesses. Consequently, we have the possibility to invest in green companies that are acting responsibly and strive towards sustainability. Also, we have the option to divest companies which do not align with our environmental and social values, or to pressure banks to do so as well.

Sustainable loans

Lastly, and similar to sustainable investments, there is the element of loans: For instance, banks could approach the stance of giving out loans with a lower interest rate to private individuals wanting to use the money for sustainable investments or purchases. Otherwise, they might do the same for companies with a sustainable business model. Through this method, sustainable developments are encouraged and facilitated.

Conclusion

Lastly, there are many more aspects to be discussed when it comes to sustainable finance. This article served more as a starting point for further research and aimed to introduce the topic. Overall, the financial services sector is currently undergoing huge changes, and the sustainable developments are able to have great spillover effects to other industries as well.

This month is about sustainability and financial institutions – become part of our Komoneed community to learn more and contribute by leaving some comments down below!

More specifically, we would like to know…

- Have you heard of the term ESG before?

- Does your bank also publish data on their sustainable financing? If yes, what does this data show?

- Are you currently investing in stocks? If yes, do you invest according to ESG assessments?

- What do you think about the EU Green Deal?

Sources

- Overview of sustainable finance | European Commission (europa.eu)

- ESG Scores | S&P Global (spglobal.com)

- ESG Investing: ESG Ratings – MSCI

- A European Green Deal | European Commission (europa.eu)

- Sustainable Finance – PwC

- Barclays-PLC-Annual-Report-2020.pdf (home.barclays)

Image

- Pixabay

Interesting article – I’ve actually recently discussed the ESG standards with a friend of mine, as she is in the finance industry. Definitely important to be informed!

Thanks Vanessa! That’s probably happen because the roots of ESG are on financial institutions

I make a point of exlusively investing in sustainable enterprises, and so far it’s paying off!

Cool!

I don’t think banks and other financial players are currently sufficiently engaged with sustainability – more needs to happen in order to improve here!

However, they are using (actually, they created) the ESG Standards… Probably, It’s still a bit controvertial

Who needs sustainable finance when we can just ride unicorns to work? 🦄

Oh sure, lets just rely on imaginary creatures to solve our real-world problems. While youre at it, why not wish for a pot of gold at the end of every rainbow too? Sustainable finance may not be perfect, but at least its a step in the right direction.

sustainable finance sounds great, but will it really make a difference? 🤔

Absolutely! Sustainable finance has the potential to revolutionize the way we approach investments and ensure a more environmentally friendly future. While it may not solve all our problems overnight, every small step counts. Lets embrace the power of sustainable finance and work towards a greener world together!

Hey guys, just read this article on sustainable finance. Do you think its really a game-changer? 🤔

sustainable finance sounds great! Cant wait to see more transparency and government engagement. #ChangeIsComing

I hate to burst your bubble, but government engagement and transparency rarely go hand in hand. Dont expect much change from the same old politicians. #SameGameDifferentName

Sorry, but money will never be cool as long as its still causing inequality and environmental destruction. Sustainable finance is just a small step towards a much bigger change we need. 💰🌍

Hey guys, after reading this article on sustainable finance, I gotta say, its about time we prioritize the planet over profit! 💚🌍

Comment:

sustainable finance seems like a game-changer! Cant wait to see governments stepping up and making a difference. 💪🌍

While sustainable finance is a step in the right direction, governments alone cant solve the environmental crisis. We all need to take responsibility and make sustainable choices in our daily lives. Lets not wait for governments, lets lead by example. 🌱🙌

I hate to burst your bubble, but governments stepping up for sustainable finance? Dont hold your breath! Theyre more interested in lining their pockets than saving the planet. Its up to us, the people, to demand change. 💪🌍

Sustainable finance is just another ploy to make us feel better about ourselves while corporations continue to destroy the planet. Investing in a greener future requires more than just throwing money at the problem. Its time for real action, not empty gestures.

Hey everyone, did you catch the article on sustainable finance? Its all about being a catalyst for change. 💰🌱 But wait, how do we even define sustainable finance? 🤔 And can we trust it to bring about transparency? 🕵️♂️ Plus, are governments really stepping up? 🏛️ Lets discuss!

I totally agree! Sustainable finance is a buzzword that needs more clarity. Trusting it to bring transparency is a leap of faith. And lets not even get started on governments stepping up. Its a nice idea, but actions speak louder than words, right? Lets keep discussing!

Hey guys, so what do you think about sustainable finance? Is it really a catalyst for change or just another buzzword? 🌱🤔

I think sustainable finance is definitely more than just a buzzword. It has the potential to drive real change by directing investments towards environmentally and socially responsible projects. Its time we prioritize the planet and future generations over short-term gains. 🌍💪