This post was originally published on Green Biz

Source: Green Biz

Meta is contracting with a little-known next-generation geothermal startup, XGS Energy, to counteract emissions from a data center campus in New Mexico that’s being expanded to accommodate artificial intelligence.

Under the deal announced June 12, Meta will support XGS’s development of a two-phased, 150-megawatt installation that will begin feeding electricity to the local grid by 2030.

This is not a power purchase agreement, at least not yet. It’s part of a broad portfolio of 13 renewable electricity and energy storage projects that Meta is supporting through a special service contract with PNM, the largest electricity provider in New Mexico. The project developers seek to use a state geothermal tax credit approved in 2024.

XGS, founded in 2008, has raised close to $60 million to develop a geothermal production method differentiated by use of almost no water and its applicability in a variety of geological conditions. Meta is its first publicly declared customer.

Enhanced geothermal technologies work by fracturing hot rock and circulating water to generate electricity. Advanced geothermal systems use a closed-loop design that doesn’t inject the fluid into the rock and are often sited at end-of-life oil and gas wells. XGS is considered a hybrid between these two approaches.

There’s only one geothermal installation in New Mexico, but state-sponsored research suggests there could be 160 gigawatts of geothermal capacity available for development. “New Mexico is not only the second largest oil and gas producer in the U.S., but also one of the nation’s leading sources of clean energy,” said New Mexico Gov. Lujan Grisham. Colorado, North Dakota and California also support state-level initiatives.

This is Meta’s second geothermal partnership. It announced a relationship with Sage Geosystems in August 2024 with the goal of bringing 150 megawatts of electricity online in an unspecified location east of the Rocky Mountains by 2027.

Google and Microsoft support geothermal, too

Geothermal power accounts for less than 1 percent of the current U.S. electricity mix, but anticipated energy demand for data centers and bipartisan policy support for development is spurring corporate interest.

Startups working on enhanced or advanced geothermal systems have raised more than $1.3 billion from a range of investors including oil majors such as Chevron and Baker Hughes, according to research firm Wood Mackenzie.

Wood Mackenzie estimates the Great Basin region including Nevada, Utah and parts of California, Oregon and Wyoming could support at least 135 gigawatts of capacity, or roughly 10 percent of the U.S. power supply.

Fervo Energy, an enhanced geothermal company that has inked a high-profile deal with Google for a 118 megawatt project in Nevada, disclosed an additional $206 million in project financing June 11 that will help advance its Cape Station project in Utah, the first phase of which is slated to become operational in 2026.

Microsoft’s biggest bet on geothermal for data centers, so far, is outside the U.S. in Kenya, where it’s investing $1 billion in an AI facility with G42, a development company from Dubai.

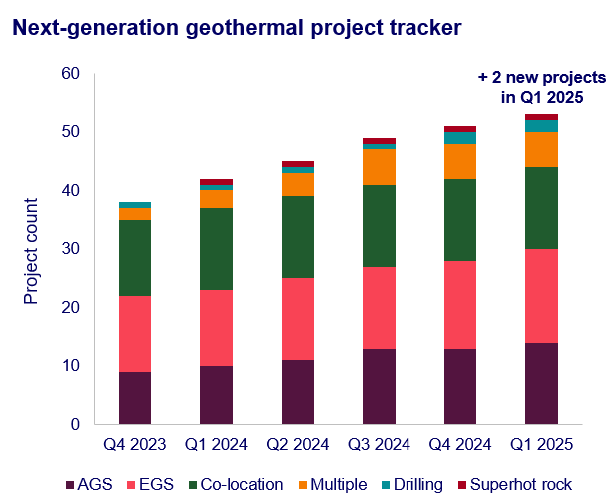

Positive project pipeline

Data centers are a rapidly growing business in the U.S., and corporate power purchase agreements will be critical for securing more projects, according to Wood Mackenzie analysis. Geothermal is one of the rare renewables receiving bipartisan support: As of this writing, it appeared federal tax credits would be spared in the budget winding its way through the U.S. Senate.

Even without those credits, the levelized cost of energy from next-generation geothermal projects such as Cape State is about $79 per megawatt-hour.

“Tax credits should serve as a catalyst, not a crutch,” said Annick Adjei, senior research analyst with Wood Mackenzie. “They help build a competitive U.S. geothermal industry with global leadership potentially. Fortunately, [enhanced geothermal] projects are increasingly viable without them, and continued innovation is expected to drive costs down further.”

The post Meta geothermal deal highlights growing interest in renewable alternatives appeared first on Trellis.

0 Comments