This post was originally published on WBCSD

WBCSD had a strong presence at this year’s London Climate Action Week (LCAW) matching the event’s unprecedented numbers: 2025 was the largest of its seven iterations, hosting over 45,000 people and more than 700 events. With a unique blend of high-level engagement from public and private actors, last week was, in the words of our CEO Peter Bakker, “encouraging” and reenergizing.

With active participation from government, notably from COP30’s Brazil and host country, UK, a lot of the discussions were centred on key steps to ensure targets are met and COP30 delivers the implementation needed. “How” (Sue Lloyd, Vice-Chair, ISSB)was the focal point of the agenda. No more talks of ‘why’, ‘what’ or ‘when’. The urgency was palpable; there was consensus in most (if not all) rooms that the time is ‘now’.

Recurring points were heard by different stakeholders in sessions throughout the week, underscoring shared priorities – scaling and speeding decarbonization; mitigating risk and building business and supply chain resilience; transitioning with nature and people at the centre; shifting the narrative from sustainability to board language; aligning the real economy and financial markets to unlock capital; driving value-creation through climate action. Leaders agreed, the message was clear: business leadership is key-but systemic change demands close collaboration.

If not now, when? If not in Belém, where?

Rachel Kyte, UK Special Representative for Climate

WBCSD hosted numerous sessions (35) and joined worthwhilediscussions on several stages around town, from the World Climate Investment Summit, to Reset Connect, to the London Stock Exchange to Goals House.

We kickstarted the week with the release of the ‘Business Breakthrough Barometer 2025’. Launched by Climate Champion Dan Ioschpe & Peter Bakker to a packed room, the event also counted with reflections from Ana Toni (COP30 CEO) & Kerry McCarthy, Minister for Climate at DESNZ, plus fireside chats on the need for leadership from both business and policymakers to deliver on the net zero transition.

Several roundtables were also hosted on Monday, focusing on AI, transport decarbonization and Physical Risk. The latter, convening over 30 corporates and financial institutions, explored how expectations are rising with investors demanding transparency, regulators embedding physical risk into disclosure standards, and insurers tightening coverage. Notable points raised included the materialization of climate risk, the need for a resilience mindset, and the importance of forward-looking risk management. Key takeaways included the importance of sustainability and resilience for long-term competitiveness, with leading companies demonstrating that proactive investment can turn physical risk threats into business opportunities.

Later in the evening, WBCSD welcomed members to discuss business leadership on the road to COP30, in a cocktail reception outlooking London’s skyline.

ESG not for ESG’s sake

Fiona Watson, VP CP&A, WBCSD

On Tuesday, the focus was on decarbonization across supply chains, electrification solutions, financing regenerative agriculture – where we saw growing momentum on alignment and framing of action to deliver on ‘food sovereignty’ and ‘food security’ – and, at the “Embedding sustainability as a driver of long-term enterprise value” roundtable,the CP&A team and ERM along with corporates, finance, and sustainability leaders, highlighted bridging internal silos; integration of sustainability into financial quantification; and reframing the ESG narrative (“risk is the Board’s language”) as some of the ways to deliver on both net zero and economic growth.

The Climate team launched the ‘Avoided Emissions & Climate Investing: A guide for investors and businesses’ – a guide on climate investing and the emerging methodological landscape of Avoided Emissions (AE), and brought together WBCSD members with more than 30 investors from Impact Convergence Forum and Project Frame to discuss convergence of methodologies and frameworks for assessing AE, concluding impact-linked incentives and benchmarking at industry level are needed to scale financeable solutions.

And, following the release of ‘Adaptation Planning for Business – Navigating uncertainty to build long-term resilience’, a guide to support businesses to design, implement, and finance adaptation solutions required to build resilience ahead of LCAW, the Climate Adaptation team organised a discussion with Climate High-Level Champion for COP30, Dan Ioschpe, moderated by Dominic Waughray, our Executive Vice-President, in collaboration with Global Resilience Partnership, BSR, and Center for Climate and Energy Solutions, which concluded; “resilience is a key business opportunity”.

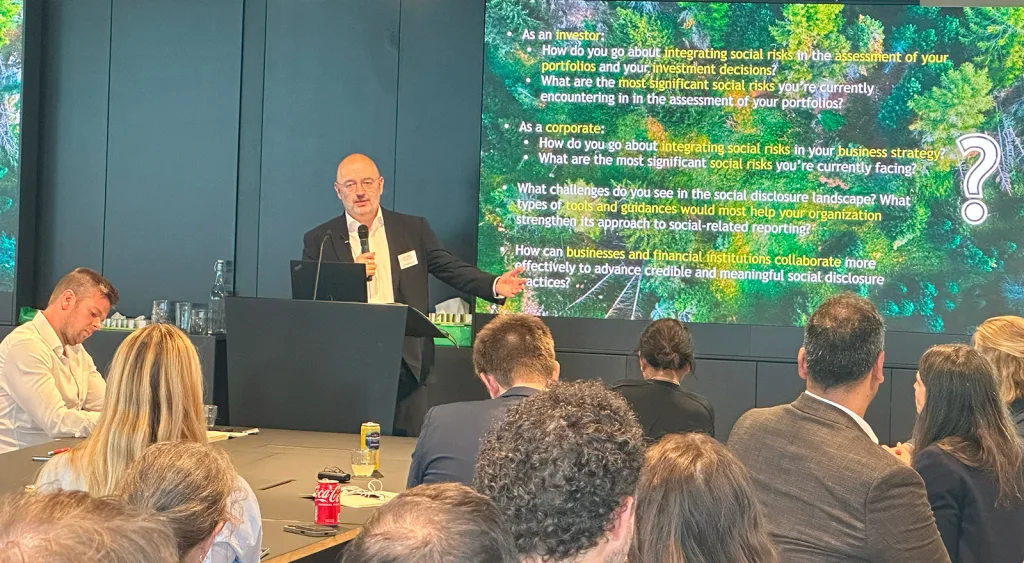

In another part of town, Peter Bakker provided insights and closing remarks at the “Social Disclosure as a Strategic Advantage in a Just Transition” session co-hosted by TISFD and BCG, as TISFD Co-Chair.

And Giulia Carbone (Director, Nature for Climate, WBCSD) spoke at the launch of the The Coalition to Grow Carbon Markets –A government-led initiative to scale carbon markets and boost finance for ambitious climate action, led by Kenya, Singapore and the United Kingdom. WBCSD has been invited to be the voice of business and support the governments in their ambition to strengthen voluntary demand for carbon credits.

Turn resolve into results

David Schwimmer, CEO, LSEG

Tuesday came to a close with the Climate Drinks (and delicious pizza!) in Broadgate, but Wednesday started bright and early, with Peter Bakker providing insights on “Global Action on Climate Transition Plans” at London Climate Action Week: Finance Live breakfast show by LSEG, the Green Finance Institute (GFI) and Reuters, alongside Elizabeth Fernando, CIO of NEST (National Employment Savings Trust) Corporation.

He then participated on a panel at the “Climate Transition Plans – Navigating the Pathway Ahead” event organised by LSEG and the International Sustainability Standards Board (ISSB) in collaboration with the Transition Pathway Initiative (TPI) and WBCSD.

During the morning event, speakers highlighted both investors (“>85% of asset owners are incorporating sustainability into their strategy” – David Schwimmer, CEO, LSEG) and business (91% have maintained or increased investments in the net zero transition over the past year – Peter Bakker, Business Breakthrough Barometer 2025) are staying committed to the low carbon transition, and explored how the finance sector views transition planning.

Michela Bariletti, Chief Credit Officer, Phoenix Group, elaborated on the “importance of integrating sustainability from initial strategic capital allocation phase”, and Richard Manley, Chief Sustainability Officer, CPP Investments, stated the need for a “system-wide transition finance agenda”. Mary Schapiro, Vice Chair and Head of the Secretariat, GFANZ, added “it used to be a challenge to convince people climate risk equals financial risk, now, it’s a given”.

Richard also commented that “transition plans are a systemic market infrastructure” because “physical risk is unavoidable”, and Anthony Miller, Head of UNSSE, echoed saying“a transition plan is a survival plan”.

The day’s discussions can be concluded with Elizabeth Fernando, CIO, NEST, remarks: “climate change is a systemic risk” and “there’s no point saving for retirement if there’s no decent world to retire into”. The morning panels were followed by a WBCSD corporate-investor dialogue working lunch.

Wednesday saw our team hosting workshops on the built environment and the just transition, and the launch of the publication ‘Navigating the investment case for co-located long-duration energy storage: Delivering 3x Renewables by 2030’ – a guide to how companies can strategically invest in storage to support long-term system reliability, and a roundtable discussion focusing on the strategic role these solutions play and how to collectively accelerate action on LDES and unlock the $4 trillion investment opportunity these technologies represent. And closed with an exclusive members’ only dinner.

We don’t have a new economy without nature and people

Marcele Oliveira, COP30 Presidency Youth Climate Champion

Thursday was an exciting day at LSEG with the World Climate Investment Summit. Our Fiona Watson, our VP for Corporate Performance and Accountability (CP&A) spoke at a panel session on “Driving Sustainable Value – Strategies for Resilient and Responsible Supply Chains” and stressed; “regulatory pressure is increasing, but companies can’t wait for perfect rules—progress depends on pragmatism and iterative decision-making”. And emphasized that collaboration is crucial for success. People are at the centre of the problem and solutions, so we need to continue scaling dialogue and break silos, internally as well as between business and finance.

The event draw to a close with high-level closing remarks from H.E. Mukhtar Babayev, COP29 President; Rachel Kyte, UK Special Representative for Climate; and Brazil’s Minister for the Environment and Climate Change, Marina Silva. Echoeing André Aquino’s earlier comment, “nature is fundamental to COP30”, Rachel Kyte concluded, “we need to invest in nature, which is at the heart of a productive economy… and focus on how to unlock capital at speed and scale… [because] if not now, when? If not in Belém, where?”.

At the Goals House, our Iris van der Velden (Program Director, Equity Action,WBCSD) joined Joni Pegram (Global Policy Lead, UNICEF) and Louise Walker (Head, Private Sector and Capital Markets Department, Foreign, Commonwealth and Development Office – FCDO) in a session spotlighting innovative partnerships and practical interventions to protect education, health, and development pathways for the next generation.

We are grateful for the collaboration and participation of our members and partners, and we look forward to seeing you at our Council Meeting during Climate Week NYC.

Business remains committed and knows what needs to be done. But it cannot be done alone; together, we’ll turn complexity into clarity and ambition into action.

The post “From morality to materiality” – Highlights from London Climate Action Week 2025 first appeared on WBCSD.

0 Comments