This post was originally published on WBCSD

It is no secret that a global energy transition requires a huge and rapid upscale in clean energy production and infrastructure and that the bill to finance it will be costly, albeit delivering valuable future economic and societal benefits. A commercially solid business case for energy transition projects, which is a prerequisite to attract financial capital, remains elusive. Establishing such business cases requires improved alignment between business, government and finance in three critical aspects: (i) aligned transition pathways for planning and decision making; (ii) shared key performance indicators (KPIs) to measure progress; and (iii) high impact energy transition policies which support businesses to deliver clean energy transition. All stakeholders must urgently work closely together to meet 2030 climate targets.

Much progress but not enough for 2030

Net zero scenarios from Bloomberg New Energy Finance (BNEF), the International Energy Agency (IEA) and the Network for Greening the Financial System (NGFS) estimate that annual clean energy supply investment ranging between USD $2.4 trillion to USD $4.6 trillion is required to keep Paris Agreement targets alive. Compare this to the USD $1 trillion mobilized in 2023. Bridging that massive gap demands significant improvement in project bankability and de-risking to attract investors.

Numerous initiatives worldwide aim to attract more financial capital to transform the energy system. Examples include ESG-labelled capital instruments such as green and sustainability-linked bonds; integration of sustainability into valuations; and growing sustainability disclosure requirements such as the International Sustainability Standards Board’s IFRS S1 and IFRS S2 standards to be adopted across jurisdictions. Each initiative has merit, but we are yet to witness requisite increases of capital flow into energy transition projects to achieve 2030 climate targets. Such initiatives have not yet moved the needle.

For many years, WBCSD and our members have actively worked to enhance sustainable energy business models, equip the business community with tools to develop effective transition plans, and provide guidance to strengthen transition narratives that better present business cases to stakeholders. These initiatives support energy companies within WBCSD membership to lead in many areas, including reporting matters. For more than a decade, they have provided climate-related financial disclosures to drive and explain sustainable business transformation. Our published guidance, such as our power utilities and oil and gas-specific implementation paths in response to the recommendations of the Task Force on Climate Related Financial Disclosures (TCFD), help businesses to increase reporting transparency, improve visibility of a company’s net zero credentials, and reduce perceived investment risks. However, finance at scale is still not forthcoming.

Improving the investment case for energy transition projects has always been at the core of WBCSD’s Energy Pathway activities. Over the last decade, for example, we promoted the scaling up of renewable energy procurement via corporate renewable Power Purchase Agreements (PPAs). The initiative primarily focused on project structure and tools to reduce off-take risk for developers and financing parties, as well as price derisking for power users. As a result, WBCSD members were responsible for nearly half of around 145 GW of corporate PPAs signed since 2015. In 2021, WBCSD members sourced an average of around 40% of their electricity consumption from renewables, equivalent to replacing the capacity of 20 coal power plants1.

WBCSD and its members continue to develop investment cases for such clean energy and decarbonization paths. But we need more. Multi-party, public-private collaboration to unlock capital is critical for the rapid scaling of energy system transformation to meet 2030 targets.

Stakeholders’ alignment on transition pathways, KPIs and high impact policies will boost clean energy investment case

A widely applicable, commercially solid, energy transition investment case is yet to catalyze the energy transition momentum required, despite positive acceleration in electrification. There are only less than six years before 2030, the year by which CO2eq emissions need to fall by about 45% against 2010 levels1. We need investment to grow more rapidly than ever before.

Improving the investment case for energy transition projects requires laser-focused, multi-stakeholder collaborative action. Aligning business, government and finance perspectives on transition pathways and plans is crucial for impact. High-level multi-party dialogue to share stakeholders’ understanding of each other’s complementary roles and expectations of transition, at the early stage, enables synergies and speeds decision-making for all.

WBCSD has demonstrated this approach through our Zero Emissions Vehicle – Emerging Markets Initiative (ZEV-EMI) in India and Mexico which drives rapid ZEV deployment through international public-private collaboration. This best practice begins with high-level public-private dialogues to set shared priorities. Demand aggregation sends clear signals to stimulate market uptake of ZEV freight. Digital collaboration supports charging infrastructure planning and helps to optimize investments. EV capacity building is essential to drive adoption and can be targeted through a gap analysis based on data and industry needs.

Alignment must also include reporting and measurement. There are many duplicative reporting requirements, voluntary and regulatory, which would benefit from simplification. Harmonizing KPIs creates a common language for stakeholders to track progress, and to inform investment decisions which support and incentivize companies.

Similarly, high impact energy transition policies must harmonize supply and demand for energy transition solutions. Policies need to be pragmatically focused on positive business incentives and designed through consultation with business, finance and government together. Multi-party approaches can lead to the improvement in energy transition business cases and accelerate capital flow into low-carbon emissions projects.

Transition pathways and plans

Energy companies, as an industry example, rely on scenario transition pathways to calibrate corporate strategies, identify actions to materialize those strategies, and set practical, real economy targets that enable progress in each companies’ sustainability journey to be monitored. They operate in sectors where long-term outlooks are critical for major long-term asset investments such as power generation, transmission, and distribution infrastructure.

Large energy companies are equipped with technical expertise, commercial business acumen, and implementation experience to assess plausible transition scenarios and derive practical plans. If transition plans fall short of achieving an ideal normative emission reduction outcome, then those practical plans may still offer emissions reductions progress which may be welcomed in a real economy context.

Similarly, transition pathways help financial institutions to set climate targets, build, and implement their own net zero transition plans2. Financial institutions, however, often rely on pathways that are not designed around plausible real economy outcomes but instead are structured to achieve ambitious climate targets. As a result, investments with the potential to reduce emissions (e.g. carbon removals) but not enough to achieve normative goals of (low or no overshoot) net zero scenarios might not proceed to final investment decision phase.

WBCSD observations from consultations with members and non-member companies indicate a limited appreciation of real economy business constraints, including but not limited to regulatory environment, supply chain readiness, technology maturity and customer affordability, in financial institution investment evaluations driven by misaligned pathways.

There is a major need to bring closer together business technical knowledge and experience with financiers’ expertise to agree on a range of transition pathways that will push business enough to pursue meaningful transition and yet are plausible enough to encourage progress.

In pursuing this, WBCSD participated in the Glasgow Financial Alliance for Net Zero (GFANZ) Working Group on Decarbonization Contribution to provide business feedback on GFANZ’s transition finance, four financing strategies, and decarbonization contribution methodologies. WBCSD also teamed up with leading financial actors: GFANZ; Partnership for Carbon Accounting Financials (PCAF); Circularity Capital; and GX League to develop an insight paper on how the concept of avoided emissions can unite business and finance together in transformative pathways. Much more collaboration and alignment is required.

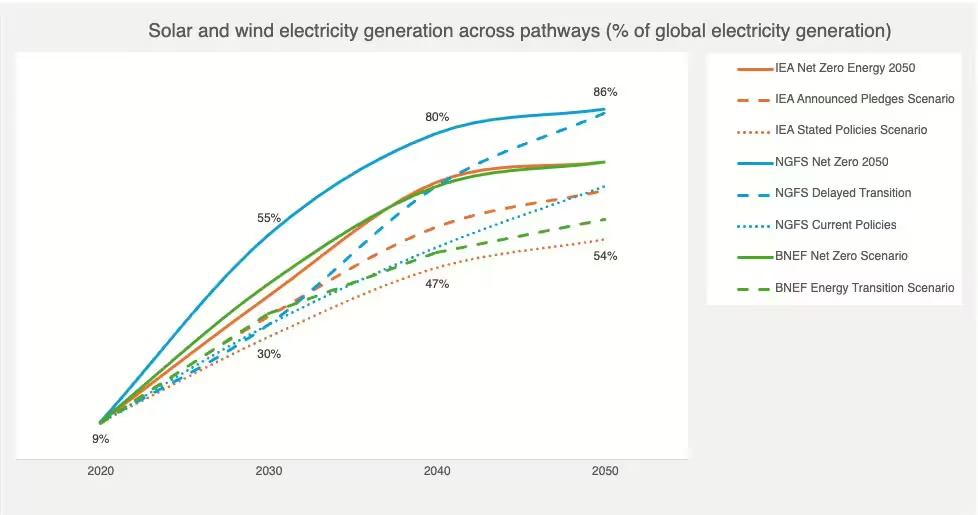

Alignment is a challenge, given the numerous transition pathways available today. In the chart below, for instance, the range of electricity powered by renewables varies from 54% to 86% in 2050. In either case, there is not enough attention on what will fill the remaining energy gap, and how to make that net zero. Projections for carbon removals also vary significantly among pathways ranging from zero to 600 MMT CO2 of annual capacity by 20503. Greatly differing assumptions on paths for decarbonization, and heroic demand reductions which are unlikely to materialize, can negatively impact investments. Narrowing such gaps between the scenario ranges used by business, finance and government stakeholders helps to better define real economy corporate transition plans that should be supported.

Key performance indicators (KPIs)

Aligning transition pathways between stakeholders synchronizes a plausible range of energy transition pathways for investors, with complementary corporate transition plans. Simplifying and standardizing KPIs at granular level provides reports and measures of short- and long-term progress delivery to monitor those corporate plans.

KPIs play a crucial role in business to measure progress, identify areas of improvement and to course-correct decisions. Well-chosen KPIs steer companies’ resources towards their specific goals and effectively communicate progress and achievements to stakeholders.

Many encouraging standards and regulations form the basis of sustainability reporting and KPIs best practices. General guidance on climate-related disclosures such as the TCFD have evolved into global accounting standards by the ISSB. More jurisdictions worldwide are considering roadmaps and pathways toward mandatory application of ISSB Standards.

These welcome standards are principles-based and designed to stand the test of time. Individual companies assess the materiality of their business and operations in applying such standards and prepare financial statements accordingly.

However, companies also increasingly face the challenge of adhering to non-harmonized, regulated disclosures where they operate. For instance, companies operating in Europe and in the US need to report their environmental impact as required by Europe’s Corporate Sustainability Reporting Directive (CSRD) and the US Securities and Exchange Commission (SEC). As a result, differing regional practices will lead to varying reporting and disclosure practices and potentially confuse investors, government agencies, corporate and sustainability rating providers and other report users.

It is efficient to harmonize those differing practices and develop a “common language” in KPIs to communicate on sustainability credentials. An example of such harmonization can be achieved by building further on the ISSB S2 Standard and related regulations to standardize financial metrics to report climate-related impacts. Doing so will improve comparability across companies and better support lawmakers, financiers and other stakeholders in their respective decision-making. Common KPIs simplify processes and optimize financial and human resources allocation to address reporting requirements.

High impact transition policies

Pursuing the above two multi-stakeholder alignments – in transition pathways and in harmonizing KPIs – can only unleash their full potential to rapidly accelerate energy transition investment if they are supported by high impact energy transition policies which incentivize demand for energy transition supply across multiple sector value chains.

National and international policies that nurture clean energy market offtake and corridors are essential for the momentous multi-sectoral change we seek for the energy transition. Many risks that contribute to unattractive risk-adjusted energy transition investment returns are structural. Legacy policy structures must evolve to create more conducive operating environments for companies to transition. Examples of elements of high impact policies include support for technology maturation, stability for project timeline predictability, supply chain readiness, infrastructure connectivity, early-stage affordability and stimulating consumer demand.

Clean energy markets which rely on organic growth alone will likely not achieve the pace of transformation needed. Clean energy is far behind the ubiquity and scale of the conventional fossil-based energy system. Market participants need strong policy interventions to instill the behavioral and ecosystem changes required. Countries such as the US and China have adopted high impact energy policies to catapult respective clean energy investments.

There is no “one-size-fits-all” high impact policy playbook. Consider different mechanisms adopted such as US Inflation Reduction Act (IRA), EU Green Deal and China’s clean energy policies, which each reflect regionally nuanced approaches and decarbonization goals.

Accelerating the policymaking process in any case will benefit from government and business partnering to explore policies to pursue. Companies possess industry-specific knowledge, practical experience, and insights which can inform policymakers of real-world challenges and opportunities early in the process. Fostering early alignment between policy goals and economic interests, including private capital, may speed up implementation.

Moving forward together

Reaching alignment in the three collaborative areas – transition pathways and plans, key performance indicators, and high impact energy transition policies – demands business, government and finance to urgently work together more closely than ever.

At WBCSD, we continue to convene multi-sectoral collaborations where we represent the business community and our members. For example, we are in partnership with the Power Breakthrough Agenda where we collaborate with government partners to advance tripling renewables and to deliver goals at key events such as COPs. Through RE-Source, Europe’s leading forum for corporate renewable energy sourcing, we foster collective action and propose solutions to help energy buyers and sellers adopt low-carbon solutions in Europe.

We also work as a business community in our workstreams to support the business case for clean energy solutions and attract more financial capital investment. Examples include:

- WBCSD’s Low-carbon Hydrogen, Decarbonizing Heat, and Carbon Capture, Storage and Removal workstreams, which bring together market players across the supply chain to explore net zero market creation through novel business models, supporting toolkits and commercial terms, and closing market knowledge gaps to build capacity.

- We recently launched the third edition of Energy Climate Scenario Catalogue in partnership with McKinsey Sustainability. This collects key scenarios in one place, and enables companies to compare and interrogate scenario data, conduct strategic climate resilience assessments, and refine transition plans timely and effectively.

- Our ongoing multi-year work on sustainability disclosures such as Quantifying Climate-related Financial Impacts in the Oil and Gas Sector continue to provide energy companies and others with guidance and best practices to narrate their sustainability approaches transparently and credibly to stakeholders.

- Industrial transformation features in our ongoing and future initiatives, focusing on supply and demand of cleaner energy in industrial infrastructure, transportation and mobility.

- The WBCSD Centre for Decarbonization Demand Acceleration project, a new offering under our 2025 Action program, aims to identify aggregated decarbonization within sectors, capture best practices in procuring decarbonization solutions, and facilitate member participation to spur further demand.

These efforts, and many more, complement one another. WBCSD is building bridges between stakeholders to unlock finance for the energy transition. We aim to align transition pathways and plans for planning and decision making; agree shared key performance indicators to measure and track progress; and advocate for high impact energy transition policies which support businesses to deliver clean energy transition.

Together, we must now move the needle, and finance the energy transition. WBCSD welcomes partners to participate with us in multi-party, public-private dialogue to transform the energy system faster and attract increased capital flow to meet 2030 climate targets.

Visit our page for more information about the Energy Pathway team and the work we pursue to improve business case for energy transition projects.

1 – WBCSD analysis based on data gathered by CDP excluding outliers.

2 – GFANZ. Guidance on Use of Sectoral Pathways for Financial Institutions, June 2022.

3 – Resources for the Future. Global Energy Outlook 2024, April 2024. Fig. 16: Global Direct Air Capture

The post Financing the Energy Transition: Moving the Needle first appeared on WBCSD.

0 Comments